can you look up a tax exempt certificate

Choose Search and you will be brought to a list of organizations. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue.

Free 10 Sample Tax Exemption Forms In Pdf

Complete the Type of Business Section.

. Although you cannot search by tax exempt number you can search by the organization and location. Exemption certificates are signed by purchasers and are given to sellers to verify that a transaction is exempt. Understand the nature of sales tax exemptions.

As a seller or lessor you may charge the gross receipts tax amount to your customer. Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a. Sellers are required to charge sales tax on all transactions subject to tax except when a jurisdictions rules allow for the sale to be made tax-exempt.

The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account. Since the tax records of a tax exempt organization are made available as a part of the IRS public disclosure policy anyone can request copies of those records from the IRS. Verification of tax-exempt resale certificate can be carried out through the official Alabama State website.

Benefits of Tax-Exempt Status. You can find out if the exemption status has been reinstated by reviewing the Pub. An IRS agent will look up an entitys status for you if you.

Tennessee Click Verify Sales and Use Tax Certificate Then choose the. Tax Exempt Organization Search Tool. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax.

Form 990-N e-Postcard Pub. Use-based exemptions are those created by the type of use the product. Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax.

Choose the option that enables you to search by the business name or the owners name. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data. Generally an exemption is a statutory exception that eliminates the need to pay sales tax.

Enter your name or the name of your business. Sellers should exclude from taxable sales price the transactions for. Another way to check the tax exempt status of a company or organization is to call the IRS directly at 1-877-829-5500.

The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation. If you cannot remember whether you. Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item.

The presumption is that all sales of tangible personal property are taxable unless. Form 990 Series Returns. How to get a tax exempt certificate will vary by state and will depend on the type of certificate you want to obtain.

When accepting a resale or tax exemption certificate it is important to ensure that a buyer provides you with a valid document. You can also search for information about an organizations tax-exempt status and filings. An exemption certificate is the.

The purchaser fills out the certificate. A Nontaxable Transaction Certificate NTTC obtained from the Taxation and Revenue. 78 Data for 501c3 organizations or reviewing its determination letter which would show an effective.

Sales and Use Tax Certificate Verification Application. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic. Due diligence can require verification.

You may call in and verify the information provided on the South Dakota Exemption Certificate. Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item. Sales can be exempt for any of three basic reasons.

Automatic Revocation of Exemption List. Sales and Use Tax Exemption Verification Application. You can verify that.

Tax-exempt certificates act as proof that.

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Free 10 Sample Tax Exemption Forms In Pdf

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

How To Register For A Tax Exempt Id The Home Depot Pro

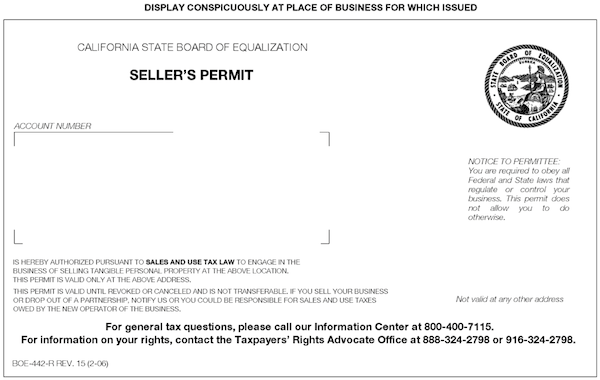

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Free 10 Sample Tax Exemption Forms In Pdf

Free 10 Sample Tax Exemption Forms In Pdf

Costco Tax Exempt Fill Out And Sign Printable Pdf Intended For Best Resale Certificat Letter Templates Letter Templates Free Certificate Of Completion Template

Tax Exempt Meaning Examples Organizations How It Works

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

Resale Certificate Request Letter Template 11 Templates Example Templates Example Letter Templates Certificate Templates Business Plan Template

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors